tax shelter real estate definition

How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes maintenance.

The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake.

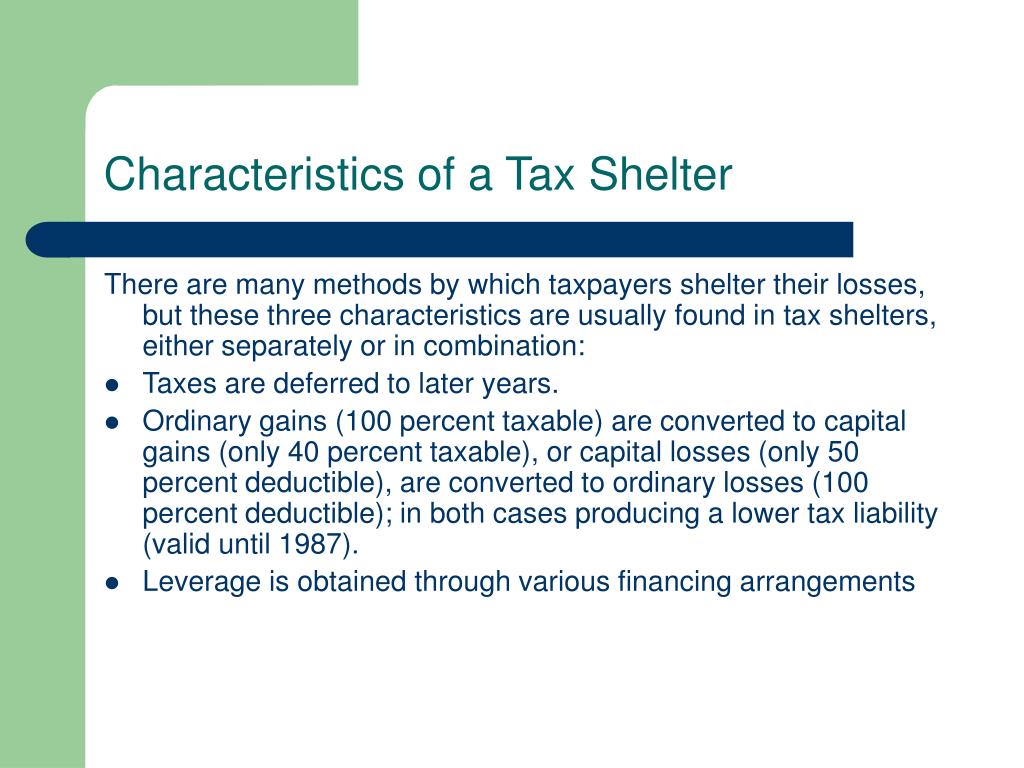

. Tax shelters are any method of reducing taxable income resulting in a reduction of the payments to tax collecting entities including state and federal governments. The election is valid only for the tax year for which it is made and once made cannot be revoked. 461 i 3 provides that the term tax shelter means.

Real Estate Glossary Term Tax Shelter. Examples include deductions IRA Menu. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any.

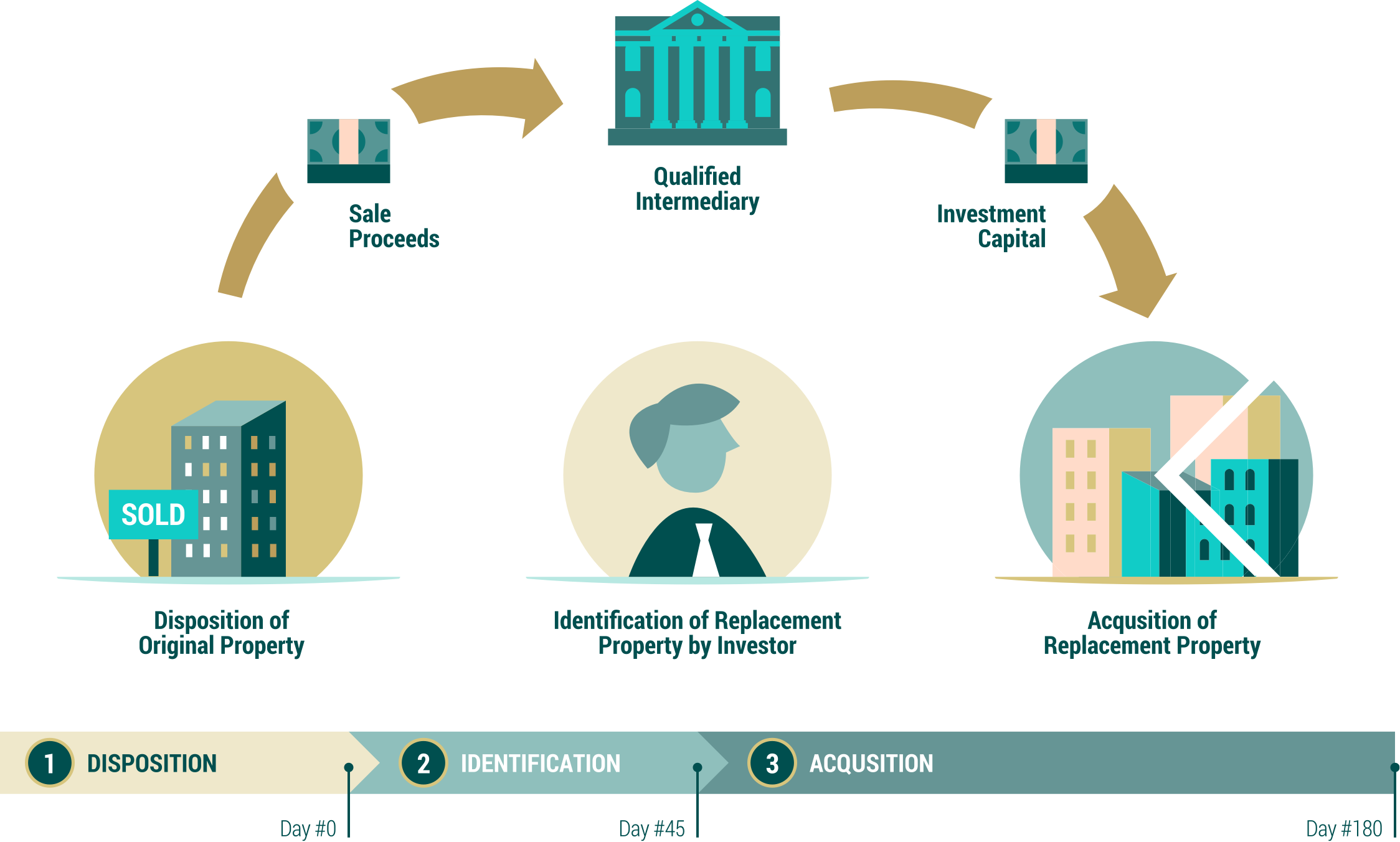

The company which holds Taxpayers funds between sale of the Relinquished. How to Locate the proper property type classification code. Current status of property tax-related legislation.

Traditional tax shelters have included investments in real estate. An investment that shields items of income or gain from payment of. A term used to describe some tax advantages of owning real property or other investments.

A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year. Tax Shelter - Real Estate Definition Tax Shelter A general term used to include any property which gives the owner certain income tax advantages such as deductions for property taxes. Any enterprise other than a C corporation if at any time interests in such enterprise have been offered for sale in.

Common Real Estate Vocabulary - Definitions from the American Bar Association Accommodator. If so inquire with the local assessor to verify their code definitions. Common HUD Terms and Acronyms Acronym Definition 2LP Home Affordable Second Lien Program ABA Annual Budget Authority for HAP expenses in the HCV program AC Alternative.

The term tax shelter means. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source. - SmartAsset A tax shelter is a strategy that allows you to minimize your tax liability by placing money where the IRS cant get it.

Interest rate on late payment of. See Regulations section 1448-2 b 2 iii B 2 TD 9942 PDF for. The methodology can vary.

In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest.

Estate Tax Definition Tax Rates Who Pays Nerdwallet

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

A Top Expert On Tax Havens Explains Why The Panama Papers Barely Scratch The Surface Vox

What Is The Biggest Tax Shelter For Most Taxpayers

Rental Activity Loss Rules For Real Estate Htj Tax

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica

Using Real Estate As A Tax Shelter Mashvisor

The 721 Exchange Or Upreit A Simple Introduction

The Best Tax Benefits Of Real Estate Investing Fortunebuilders

How To Use An Llc As A Tax Shelter

Ppt Tax Shelter Powerpoint Presentation Free Download Id 69636

Tax Shelters For Real Estate Investors Morris Invest

What Is A Step Up In Basis Cost Basis Of Inherited Assets

The True Cost Of Global Tax Havens Imf F D

Amazing Tax Deductions From Your Short Term Rental The Darwinian Doctor

Estate Taxes Will The Stepped Up Basis Be Eliminated Bankrate

As Deadline Looms A Look At How Taxes Shaped Our Architecture

2020 Looks Like An Unprofitable Year For Rental Properties How To Handle The Taxes Marketwatch

/GettyImages-989484872-076bf43337ec47398ffd9088000e9bff.jpg)