s corp estimated tax calculator

The application does not take into account the California income taxes for founders. Income for April 1 to May 31.

B Your total withholding and refundable credits are.

. Self-Employment Tax Calculator. Lets start significantly lowering your tax bill now. There is a big struggle to navigate between how much taxes you want to pay and how much you should pay.

For the full details check out the IRSs clarification. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. If you are self-employed you have to pay both the employer and employee portion which was 153 in 2016.

The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. For example if you pay yourself.

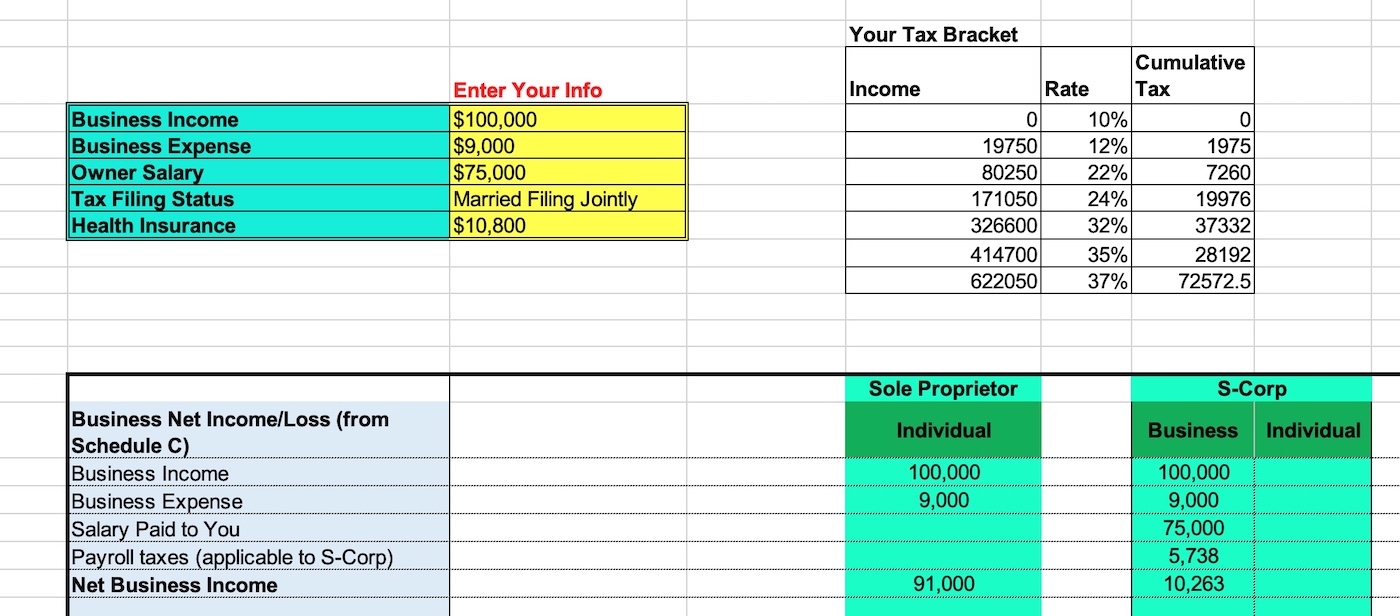

Annual cost of administering a payroll. Our S corp tax calculator will estimate whether electing an S corp will result in a tax. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

The previous years also had different tax bands which are based of how big of a profit was made which will be taken into consideration. Forming an S-corporation can help save taxes. Youre guaranteed only one deduction here effectively making your Self-Employment tax 1413 or 7065.

Less than 100 of the tax shown on. There is a lot of misconception on how to pay yourself that Reasonable Compensation when your company is an S-Corp. It is intended to give you a rough sense of the taxation for different entity types.

As a reminder Social Security is 62 of an employees gross taxable wages paid by both the employer and employee. The struggle to prove to the IRS that the compensation you are paying yourself is. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only.

See the worksheet in Form 1040-ES Estimated Tax for Individuals or Form 1120-W Estimated Tax for Corporations for more details on who must pay estimated tax. Being Taxed as an S-Corp Versus LLC. In an S corp business owners are salaried.

Compare this to income taxation for this person at 5235 without deductions taken. Income for June 1 to August 31. Enter an amount between 0 and 10000000.

Use Publication 15-T to determine the amount of federal income tax to withhold. This page and calculator are not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. - You made 400 in self-employed1099 income.

Start Using MyCorporations S Corporation Tax Savings Calculator. S Corp Tax Calculator - S Corp vs LLC Savings. If youre new to personal taxes 153 sounds like a lot less than the top bracket of 37.

Consider using payroll software to calculate S Corp payroll taxes. AS a sole proprietor Self Employment Taxes paid as a Sole Proprietor. This calculator helps you estimate your potential savings.

This allows owners to pay less in self-employment taxes and contribute pre-tax dollars to 401k and health insurance premiums. If you receive salaries and wages you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. Income from September 1 to December 31.

Medicare is 145 of gross taxable wages paid by both the employer and employee. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. Electing S corp status allows LLC owners to be taxed as employees of the business.

An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state and local income tax purposes that is elected by either an LLC or a corporation. Who Does Not Have To Pay Estimated Tax. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to 19 in 2017 and 18 in 2020.

Net business income or loss. Press spacebar to hide inputs. S corps are not taxed at the business level so there is no double taxation as in a C corporation.

Estimated Local Business tax. For example if your one-person S corporation makes 200000 in profit and a reasonable salary is 80000 you will pay 12240 153 of 80000 in FICA taxes. We are not the biggest firm but we will work with you hand-in-hand.

This tax is also known as the FICA Medicare or social security tax and is levied on your entire income. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Use this calculator to get started and uncover the tax savings youll receive as an S Corporation.

Normally these taxes are withheld by your employer. If the corporation has a valid Subchapter S election granted by the Internal Revenue Service and is doing business in South Carolina the S Corporation Income Tax Return SC1120S must be filed. S-Corp Reasonable Compensation ins and outs.

Enter your estimated annual business net income and the reasonable salary you will pay yourself as an S Corporation employee to. A You owe 1000 or more for the year 500 for corporations over the amount of withholding from any salary as an employee or refundable credits or. PAyroll taxes paid as an s-corporation With a salary of and a dividend of.

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is filed While the annual return. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Estimated payments are portioned into four payment intervals throughout the year.

Less than 90 of the tax shown on your current years tax return or. Annual state LLC S-Corp registration fees. 2021 Self-Employment taxes are estimated at 0 indicates required.

This entry is required. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125. The following January 15.

Total first year cost of. This tax calculator shows these values at the top of your results. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

You must pay estimated taxes if. From the authors of Limited Liability Companies for Dummies. IRS CIRCULAR 230 NOTICE.

Now if 50 of those 75 in expenses was related to meals and. Income for January 1 through March 31.

Excel Formula Income Tax Bracket Calculation Exceljet

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

How To Get The Student Loan Interest Deduction Nerdwallet Income Tax Preparation Tax Preparation Filing Taxes

Llc Partnership Profit And Loss Statement Business Tax Estimated Tax Payments

This Budgeting Trick Increased My Revenue By 132 And Finally Made Me Profitable Profitable Business Small Business Finance Bookkeeping Software

How To An S Corp Can Save You 5 000 Or More On Your Freelance Taxes Hyke Savings Strategy Investing Money Tax

How Much Does A Small Business Pay In Taxes

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Tax Deductions Every Online Seller Should Know About Tax Deductions Online Seller Adwords

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Llc Vs S Corp Which Is Right For Your Business Filing Taxes Income Tax Return Tax Debt

S Corp Taxes Tips Tax Preparation Llc Taxes S Corporation

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

Self Employment Taxes Business Business Tax Self Employment Small Business Tax

There Are So Many Considerations When You Re Starting A Business Especially When It Small Business Tax Deductions Business Tax Deductions Small Business Tax